When you finally’ve loaded out each of the kinds plus the financial institution has the required files in hand, the loan goes through underwriting.

The method was unbelievably straightforward. From commence to complete was simply a subject of a few days. I will certainly use Lendio Later on.

Nevertheless, Truist doesn’t publicly share its credit rating needs or fascination price details, which might allow it to be challenging to convey to if this line of credit is the best fit for you personally.

How Does LendingTree Receives a commission? LendingTree is compensated by corporations on This great site and this compensation may effects how and where by offers look on This great site (including the order). LendingTree would not include all lenders, discounts goods, or loan selections readily available during the marketplace.

Our editors are devoted to bringing you unbiased rankings and information. Advertisers never and cannot impact our scores.

To personalize your internet site encounter and to permit us to deliver the sort of articles and item choices by which you might be most interested.

Getting a line of credit in your business set up gives usage of a assured amount of money any time you need it so that you by no means find yourself in a money bind.

Sure inbound links could direct you faraway from Financial institution of The usa to unaffiliated web pages. Lender of The usa hasn't been involved with the preparing from the content material provided at unaffiliated how to secure a small business loan internet sites and won't guarantee or assume any accountability for his or her material.

Nationwide Funding’s streamlined software method and speedy funding capabilities necessarily mean business owners can typically obtain the working capital they need to have in times as opposed to months, permitting them to handle fast operational desires or surprising fees with self-confidence.

Not evaluating current business line of credit prices, terms, and qualification needs amongst lenders

Each small business demands to have the ability to adapt to alter, specifically in instances of advancement or uneven cash stream. Once you want ready access to income and flexible terms for repaying borrowed money, an unsecured line of credit can typically be a super solution.

Rates and conditions: We prioritize lenders with aggressive prices, limited expenses, versatile repayment conditions, a range of credit quantities and APR discounts.

However, the lack of collateral doesn’t mean you’re from the hook in case you don’t repay your unsecured loan. Some lenders may possibly place a lien in your business property or involve you to signal a personal ensure. Your credit rating will also probably take a strike.

During the overall approach I actually felt which they were being on my workforce, supporting me to get this carried out, wanting me to be successful, and in my corner.

Emilio Estevez Then & Now!

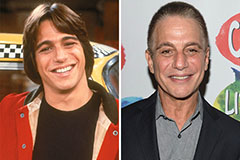

Emilio Estevez Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!